Forecasting is one of the most critical financial disciplines for any organisation that manages projects. Yet many teams still struggle with unclear projections, inconsistent billing schedules, fragmented information and manual spreadsheets that quickly fall out of date. When this happens, financial planning becomes reactive rather than strategic, leading to delayed billing, inaccurate cash flow predictions and avoidable revenue loss.

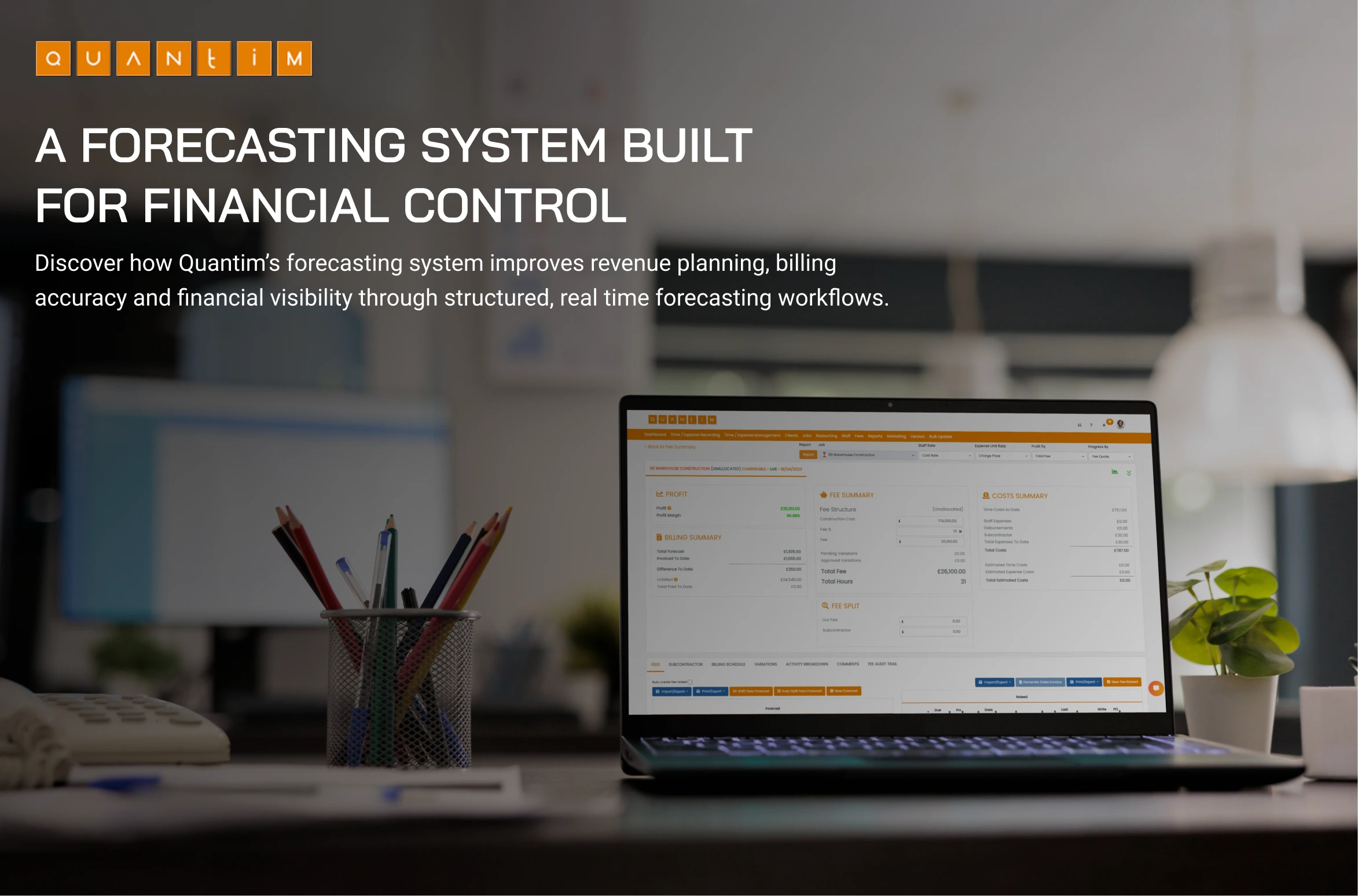

Quantim’s Forecasting System solves this problem by giving organisations a structured, real time and transparent way to plan, track and manage all future fee expectations. It replaces guesswork with accuracy and transforms forecasting into a controlled financial process rather than an administrative exercise.

Why Forecasting Matters

Forecasting directly influences:

- Revenue planning

- Cash flow stability

- Invoicing cycles

- Client communication

- Resource allocation

- Project profitability

Without a reliable forecasting method, organisations face uncertainty in billing patterns and financial outcomes. Quantim eliminates this uncertainty by providing a unified forecasting workflow that connects directly to job activities, variations and fee structures.

How Quantim Strengthens Forecasting

Quantim’s forecasting system is designed to be simple for users, while powerful enough for financial leaders who require clarity across all projects. Instead of manually calculating future fees or relying on disconnected reports, teams use a structured workflow that keeps every projection accurate and accountable.

Here are the core strengths that make Quantim’s forecasting so effective:

1. Forecasts Directly Linked to Activities and Variations

Quantim allows users to build forecasts that are aligned with specific activities or variations within a job.

This means:

- Forecasts are not generic or estimated in isolation

- Each projection is tied to a clear work component

- Teams can see precisely what each forecast represents

This activity-level clarity enhances accuracy and prevents confusion during billing or reconciliation.

2. A Unified View of All Forecasted Fees

Quantim displays all upcoming forecasts in a structured table, helping teams understand:

- What fees are planned

- When they should be raised

- What portion is already billed

- What remains outstanding

- Cumulative totals for financial tracking

This gives leaders a single source of truth for all projected revenue.

3. Optional Automation for Fee Raising

One of the most powerful features is the ability to automate raising fees based on approved forecasts.

When enabled:

- Quantim automatically generates fee entries in line with the forecast

- Billing teams no longer need to manually check dates

- Revenue cycles become more consistent and timely

Automation reduces administrative workload and improves billing discipline.

4. Granular Fee Breakdown for Complex Jobs

Some forecasts require detailed breakdowns because the projected amount spans multiple deliverables or billing components.

Quantim supports this by enabling users to:

- Split forecast values into smaller parts

- Add descriptions for each split

- Track partial billing against each segment

This level of granularity ensures that no portion of the forecast becomes ambiguous or forgotten.

5. Full Control Over Partial and Multi-Stage Billing

Not all fees are raised at once. Quantim allows teams to:

- Raise a portion of a forecasted fee

- Raise multiple fees against the same forecast

- Track remaining values easily

This flexibility is essential for organisations that invoice in phases, milestones or progressive stages.

6. Real Time Tracking of Billed and Paid Amounts

Quantim keeps a live record of:

- Total amount billed against each forecast

- Payments received

- Remaining amount yet to be billed

- Cumulative totals across the job

This real time transparency supports accurate revenue reporting and better cash flow planning.

Why Organisations Prefer Quantim for Forecasting

The forecasting system in Quantim is not just a tool. It is a complete financial planning framework that delivers:

Consistency

All forecasts follow a unified structure, eliminating the errors found in spreadsheets.

Accountability

Every projection is clearly linked to an activity, variation or deliverable.

Predictability

Leaders can anticipate revenue accurately for the entire financial year.

Control

Billing teams have full visibility into what needs to be billed and when.

Efficiency

Automation reduces manual workload and strengthens invoicing discipline.

How Quantim Transforms Financial Visibility

When forecasting is connected to activities, fees, variations and billing history, organisations gain an end-to-end view of project finances. Quantim becomes the financial backbone that helps teams:

- Avoid missed billing

- Increase revenue recovery

- Improve forecasting accuracy

- Strengthen client communication around fees

- Maintain predictable cash flow

- Manage variations more professionally

This level of integration and transparency is difficult to achieve through spreadsheets or disconnected systems. Quantim gives organisations the structure needed to run financially disciplined projects.

Conclusion

Forecasting is not simply a financial task. It is a strategic practice that determines whether organisations operate with clarity or uncertainty. Quantim’s forecasting system provides a reliable foundation for revenue planning, billing accuracy and financial performance.

By linking forecasts to real activities, enabling automation and presenting a unified view of future fees, Quantim helps organisations move from reactive billing to proactive financial control.

To explore how Quantim can support your forecasting and cost management strategy, contact us at info@quantim.co.uk.